Overview

A mobile banking app that combines all credit cards in one place can streamline the user experience and provide a more efficient and secure way to manage finances. With essential features such as transaction monitoring and budget tracking, the app can transform the way users manage their finances and offer a more convenient and intuitive banking experience.

Problem

Mobile banking has become an integral part of our daily lives, allowing us to manage our finances on-the-go. However, this convenience also comes with its fair share of issues and problems. One major problem is that different credit cards use different apps, making it cumbersome for users to keep track of their finances across multiple platforms. This can lead to confusion and even potential security risks. To address this, there is a need for a comprehensive mobile banking app that can combine all credit cards in one place. Such an app would simplify the user experience and offer a more streamlined way to manage finances, making it easier to keep track of transactions and monitor account balances. With a one-stop-shop for mobile banking, users can avoid the hassle of switching between different apps and enjoy a more secure and efficient banking experience.

Ideation

In the ideation phase, extensive research and brainstorming are essential to develop a unique mobile banking app that combines all credit cards in one place. The focus should be on creating a user-friendly interface with features such as transaction monitoring and budget tracking, while addressing pain points associated with managing multiple cards.

Prototype

The Incubus mobile banking app prototype has a simple and intuitive user interface, a card-swiping feature, and customizable preferences. Biometric authentication and encryption for security, and was designed using the Double Diamond methodology with a user-centered approach.

The process

Double Diamond

Double Diamond is a comprehensive design methodology that offers a problem-solving framework to develop the mobile banking app, Incubus. It comprises four key stages, including discover, define, develop, and deliver, with a focus on user-centered design, collaboration, and iteration.

Following this sophisticated methodology, the design team can empathize with the users, identify their needs and pain points, ideate potential solutions, and test and refine the app to create a seamless and efficient banking experience.

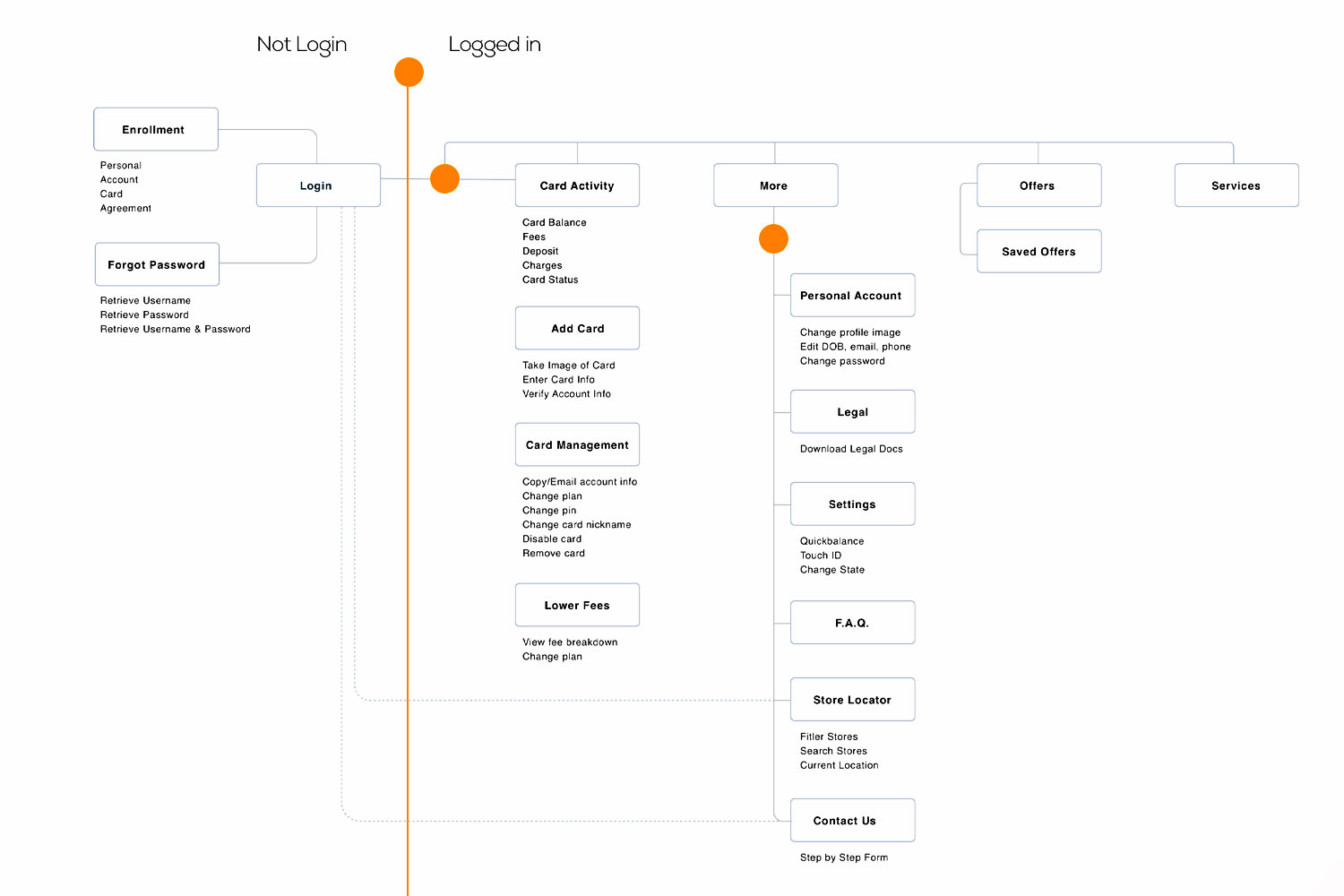

System Architecture & Function

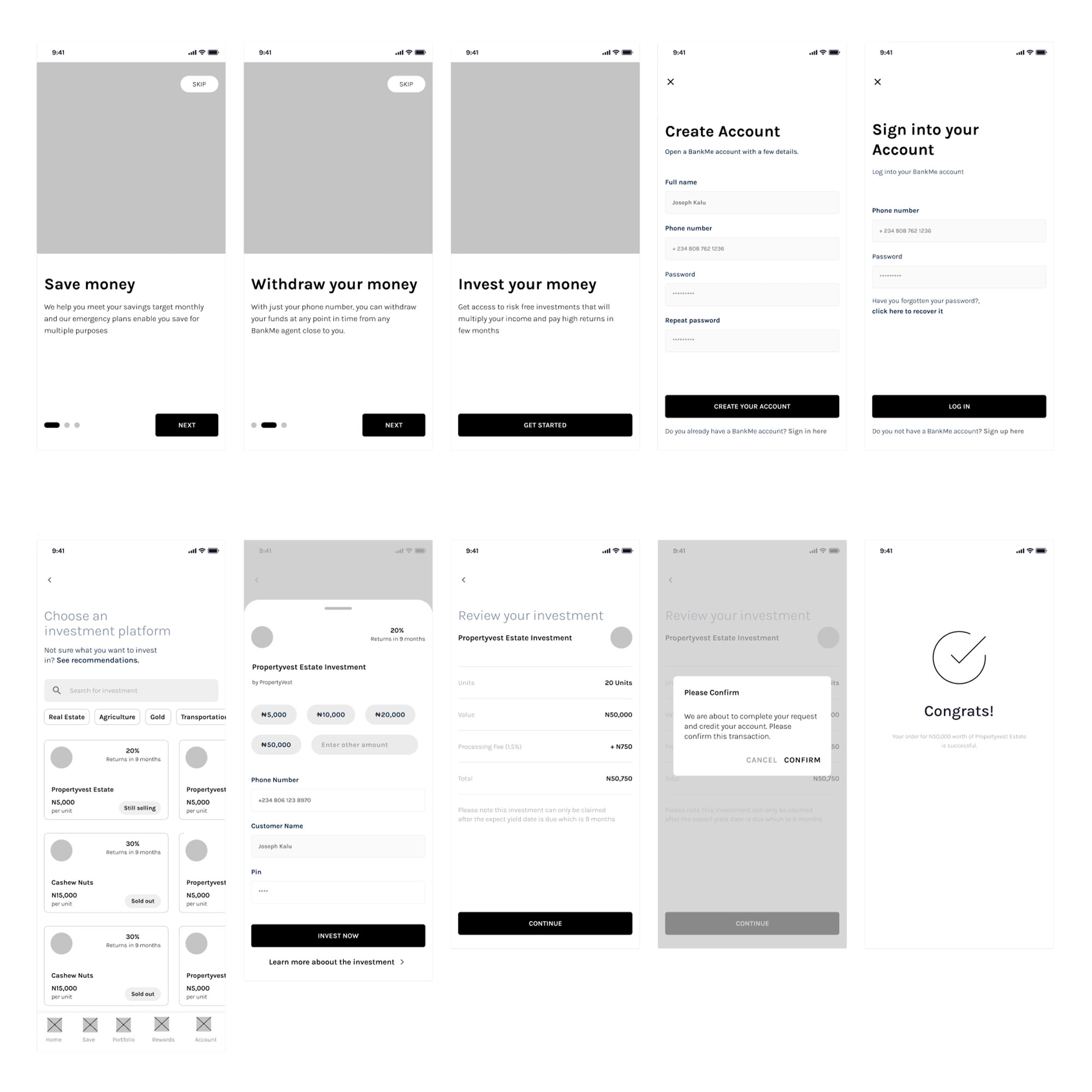

Onboarding

When users first open the app, they will be prompted to create an account or log in. The onboarding process will gather basic information such as name, email, and password to set up the account.

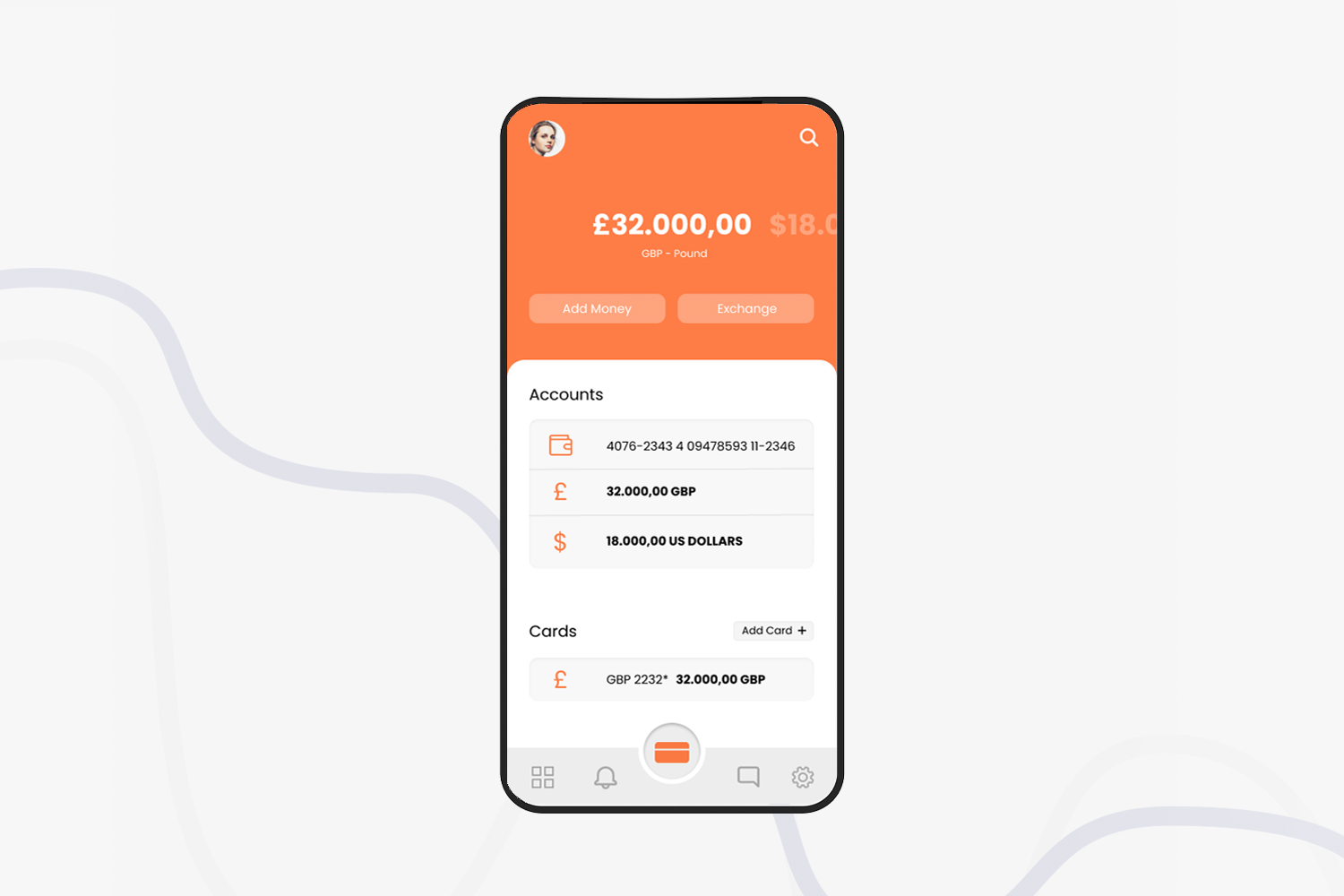

Account Dashboard

Once the user logs in, they will be taken to the account dashboard. The dashboard will display an overview of all the linked credit cards, account balances, transaction history, and other relevant information.

Linking Credit Cards

To link a credit card to the account, users can navigate to the "Add Card" section and input the card details, such as the card number, expiration date, and CVV.

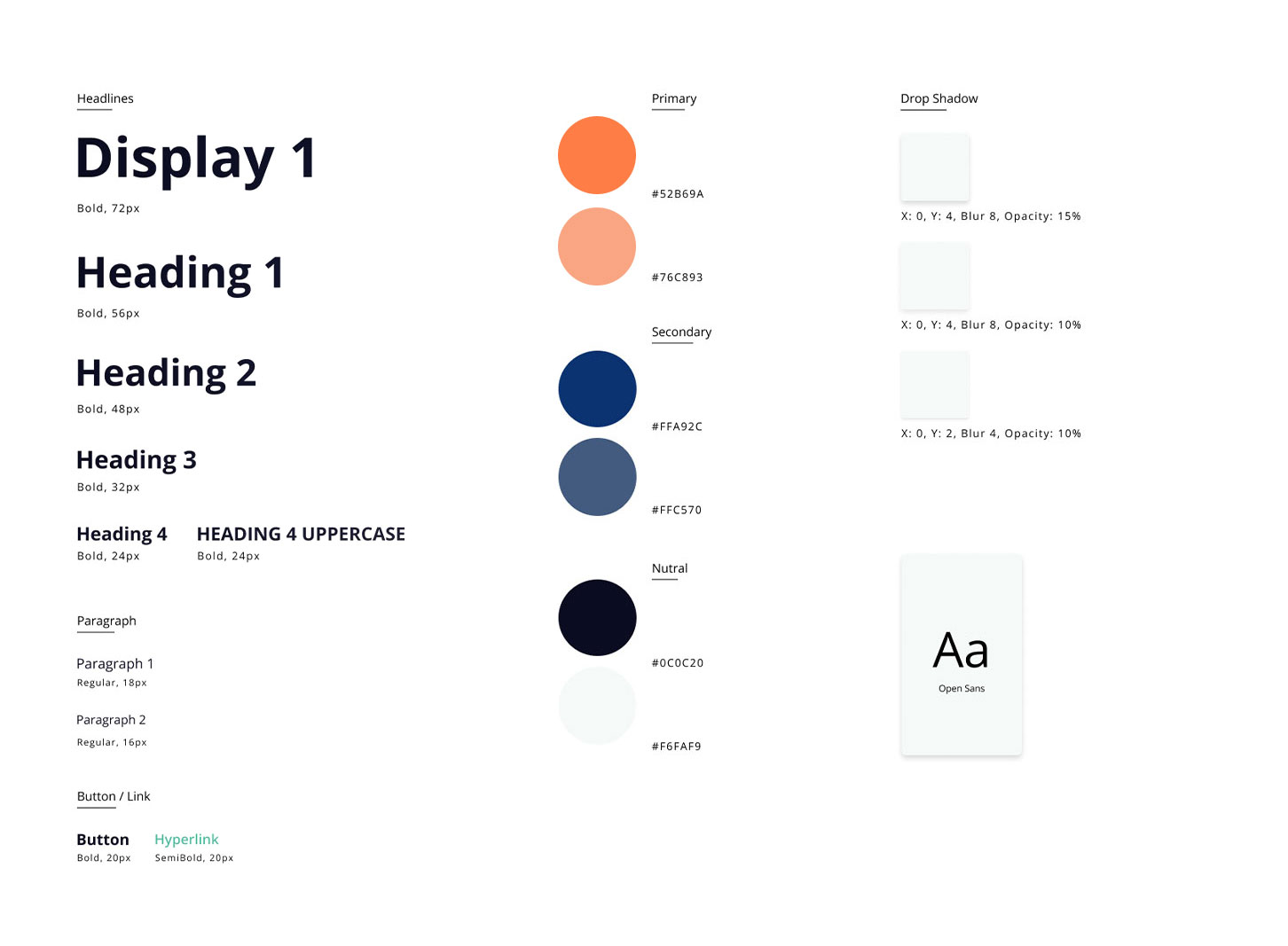

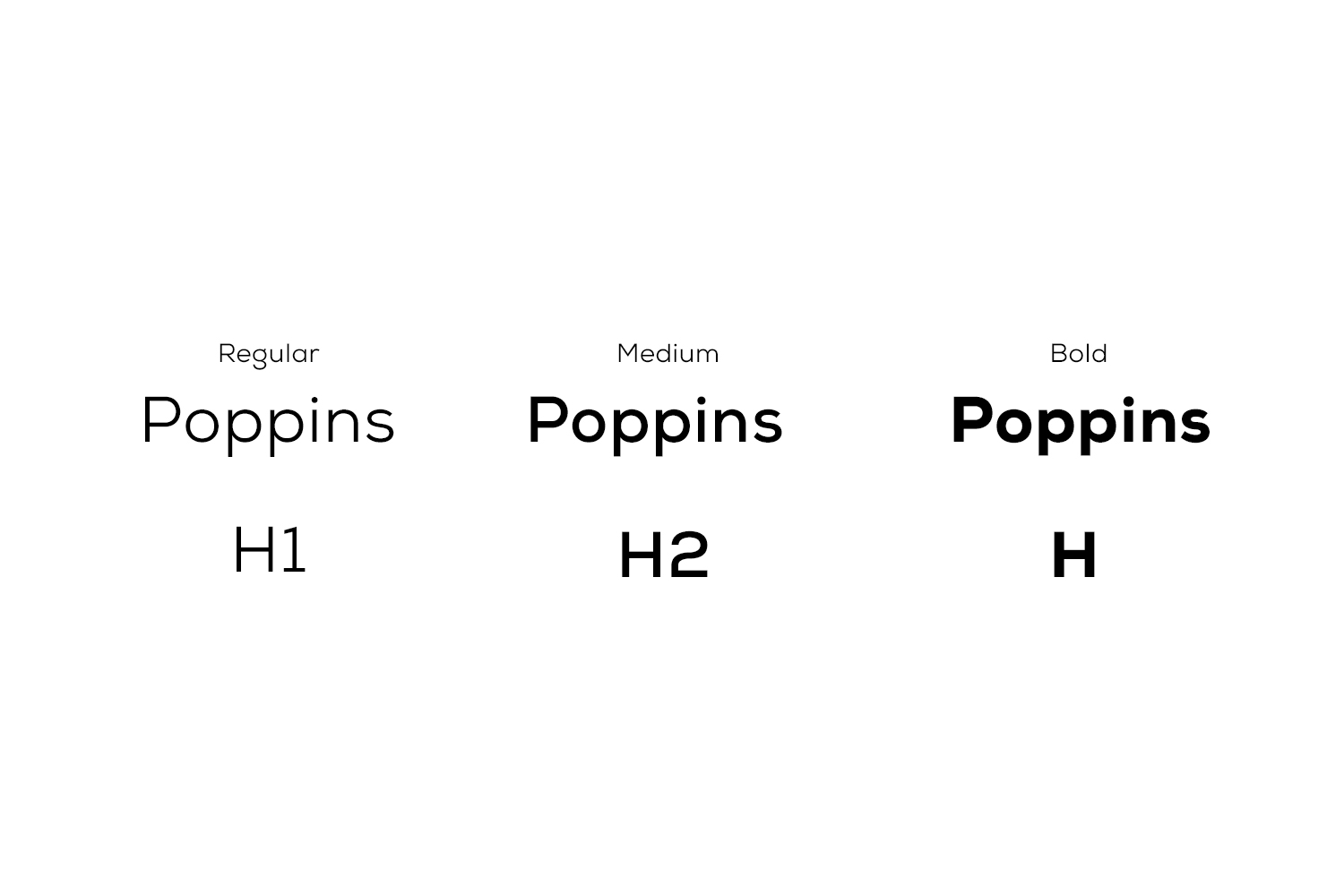

Typography, Colors

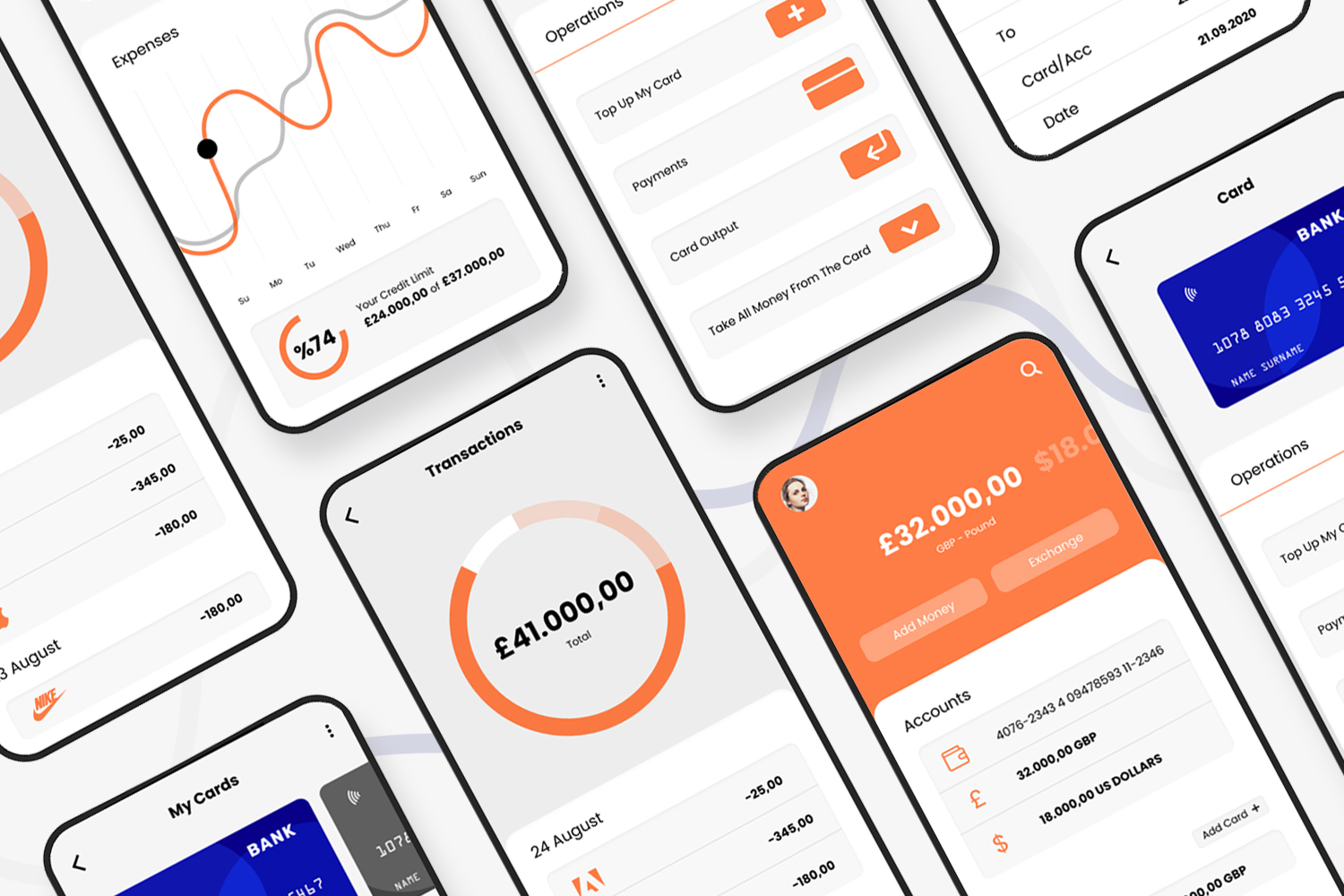

Wireframes

Next comes the mockup — the interface. Mockups should be visual. This is the documentation where the user solidify our visual decisions, experiments with alternatives, optionally build up pixel-perfect crafts

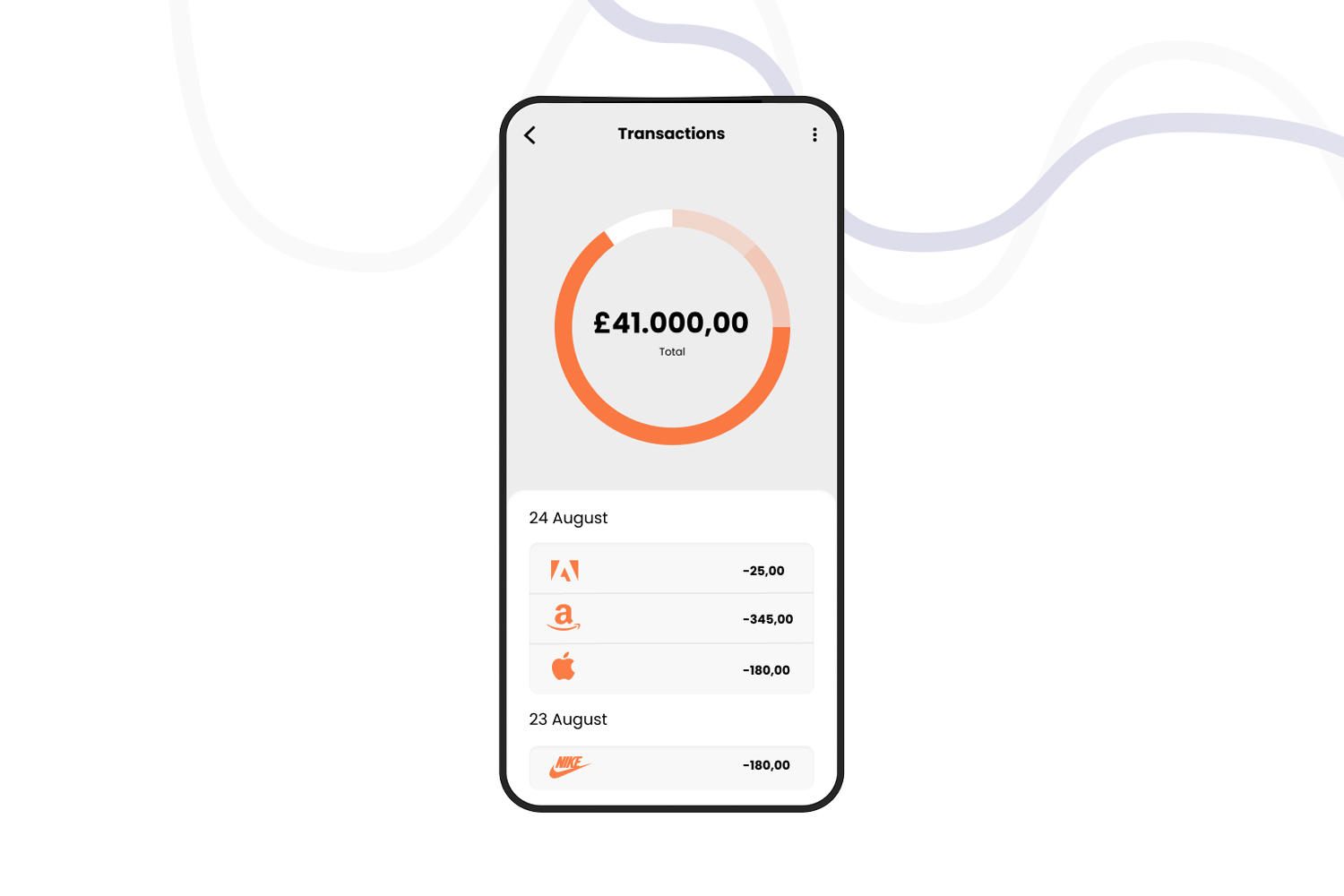

Transactions history

Users can view their transaction history by selecting a specific credit card from the dashboard or accessing the "Transaction" section. The transaction history will display the date, amount, and merchant name for each transaction.

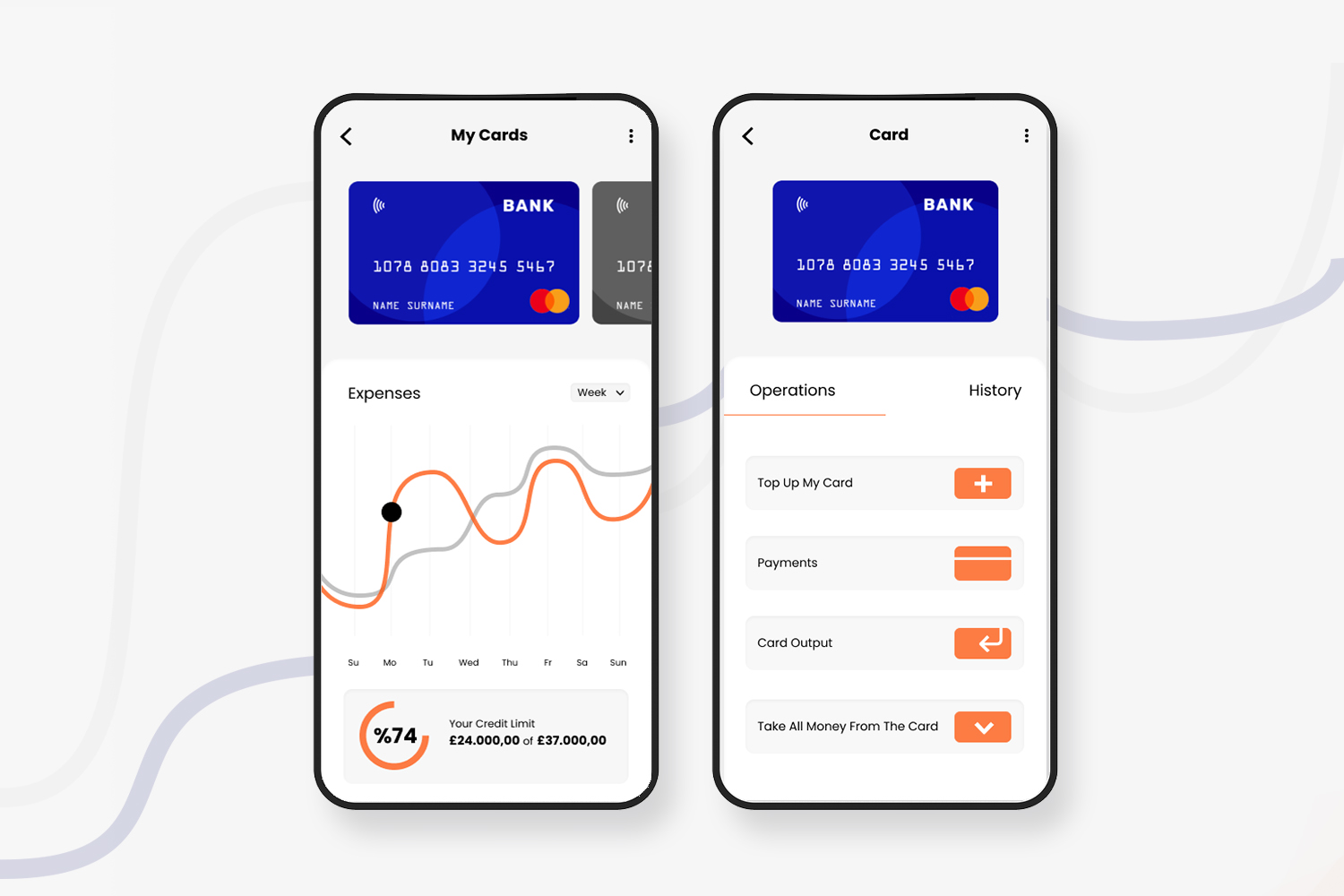

Payments

The payments section will allow users to make payments directly from the app. Users can select a credit card, input the payment amount, and choose the payment date.

Operations

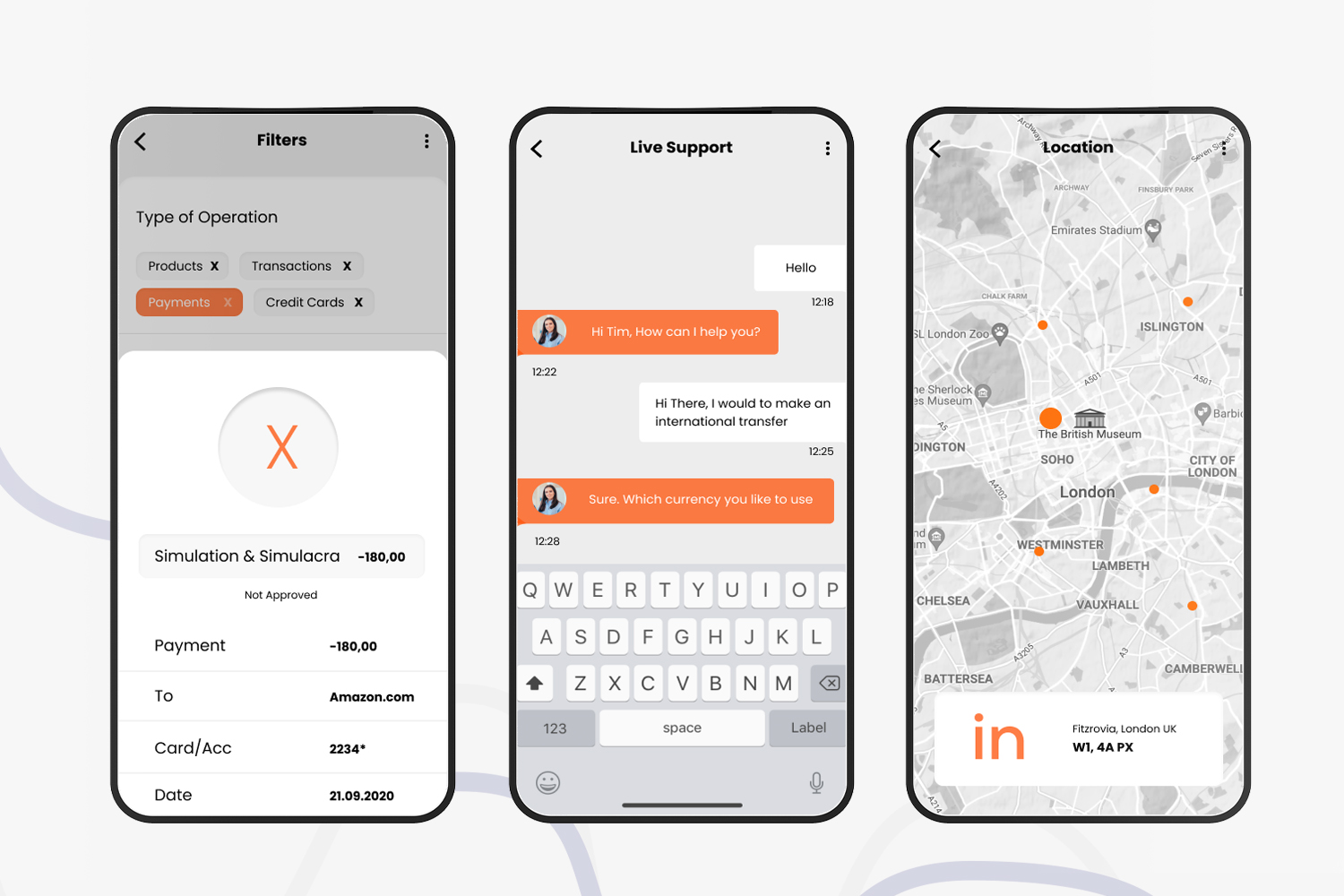

Incubus’ application has rich functionality, so you can make any money operations.

User Interface

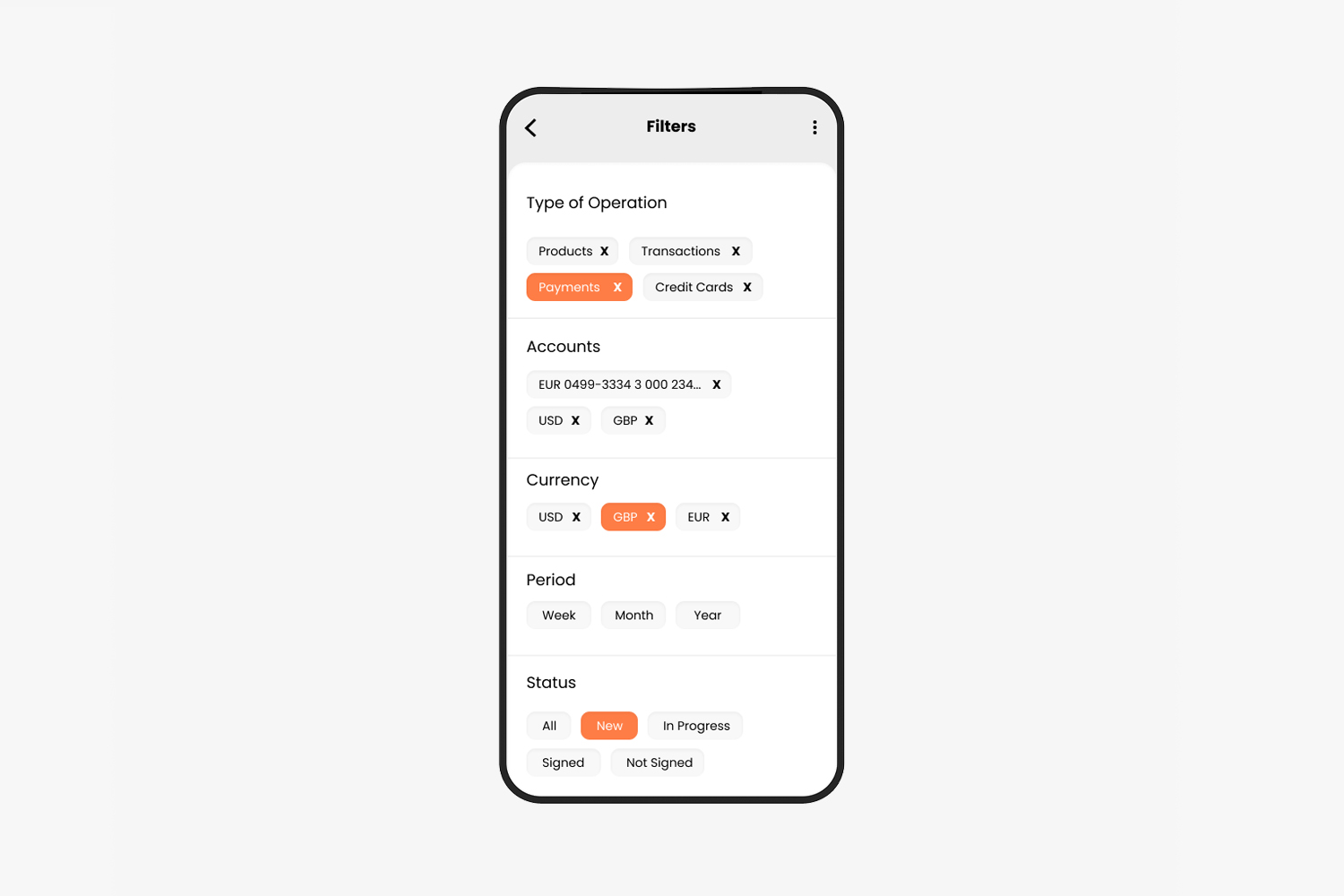

Filters

Filters play an important role in the transfer of funds, they help a person to correctly

Configure the functionality and not make a mistake when sending money.

Settings

The settings section will allow users to customize the app's features and preferences. This can include changing the app's theme, setting up security features such as biometric authentication, and managing linked accounts.

Result

Double Diamond design methodology and a user-centered approach, offers a comprehensive solution for managing multiple credit cards in one place. Providing a simple and intuitive user interface, users can access all their credit card information, transaction history, and payment features with ease.

Incorporating the Double Diamond design methodology, Incubus was able to create an efficient and effective solution that met the user's needs, preferences, and pain points.

The app's benefits include saving time and effort, reducing the risk of missing payment deadlines, improving financial organization, and offering a seamless and secure banking experience. Overall, the Incubus mobile banking app serves as a successful case study in the application of a user-centered design methodology to solve real-world problems and meet user needs.

Through a user-centered design approach, integration with financial management tools, user incentives, and a focus on retention, the Incubus mobile banking app can increase user satisfaction and loyalty, creating a loyal user community that promotes the app through referrals and positive reviews.